“We are continually faced by great opportunities brilliantly disguised as insoluble problems.”

– Lee Lacocca

Welcome to the September Edition of Ryan’s Retirement Ramblings – The monthly newsletter that will bring you the latest developments from the qualified plan space & provide updates for the retirement team at DeGraaf Financial.

On A Personal Note…

Summer is slowly slipping away up here in Duluth. The leaves are changing, the nights are getting a little chilly and the Cooles said goodbye to my parents as they begin their pilgrimage to Florida……sure sign that summer is no longer. I hope all of you are hanging on to our last few days of sunshine.

Earlier this month, the inaugural Tomassoni ALS Bike Tour took place. It was a 2-day, 100-mile tour on the beautiful Mesabi Trail. For this event, Tiffany volunteered while Dante rode in the full tour since the roles are usually reversed when it comes to the Never Surrender Blizzard Tour snow-mobile ride. We were thrilled this ride raised $144,000 for Never Surrender, Inc. to help support people living with ALS. Pictured above to the far right- Terry Steinbach and Kent Hrbek, former MN Twins All-Stars who rode in the Tomassoni Tour.

46% of 401(k) Investors Are Clueless About Their Investments, CNBC Survey Finds. That’s Not Always Bad

- 46% of 401(k) investors don’t know what investments are in their plan, a CNBC survey, conducted by SurveyMonkey found.

- That’s not necessarily bad if they were automatically enrolled into a target date fund, financial advisors said.

- The bottom line: Even if a 401(k) investor is unaware that they’re saving money or clueless about the funds available for investment, it’s likely they’re exhibiting reasonable savings behavior by default, advisors said.

The Retirement Savings Glass Is Only Half Full for Women

According to recent data from the National Council on Aging and the Women’s Institute for a Secure Retirement, nearly half of women ages 25 and older lack access to a tax-advantaged, employer-sponsored retirement plan.

Digging Deeper into the Data

The top reported financial concerns among women, alongside insufficient retirement savings, include housing costs, Social Security and Medicare cuts. But unfortunately, lack of access to retirement plan benefits doesn’t paint a complete picture of the problem.

Because even among those women who are eligible for workplace retirement plans, average account balances lag behind those of men by a startling 50%, according to Bank of America’s Financial Life Benefits Impact Report. And this disparity can create a chain of negative financial consequences for both female workers and organizations.

Empowering Gen Z: Setting Your Youngest Participants Up For Success

Understandably, companies typically devote considerable attention to assisting participants nearing retirement. But the outsized value of early contributions to retirement readiness means employers should also focus on getting their youngest workers enrolled — and contributing — to their workplace retirement plan as soon as possible.

So, what do we actually know about Gen Zers’ attitudes toward retirement planning and their understanding of employer assistance in this area?

How Resuming Student Loan Payments Affects Sponsors

Starting August 29, student loan payments will be back on after a 3-year pause. What does this mean for plan sponsors? As employees prepare to, once again, deal with the financial burden of student loans, sponsors have an opportunity to help lessen the load and ensure retirement contributions don’t fall to the wayside.

One way employers can do this is by implementing an optional change laid out by the Secure Act 2.0. This provision allows employees to continue receiving retirement matching benefits from employers while forgoing retirement contributions to focus on repaying student loans. These payments would be treated as retirement contributions, meaning…

Participant Corner

Consider making a catch-up contribution to your retirement!

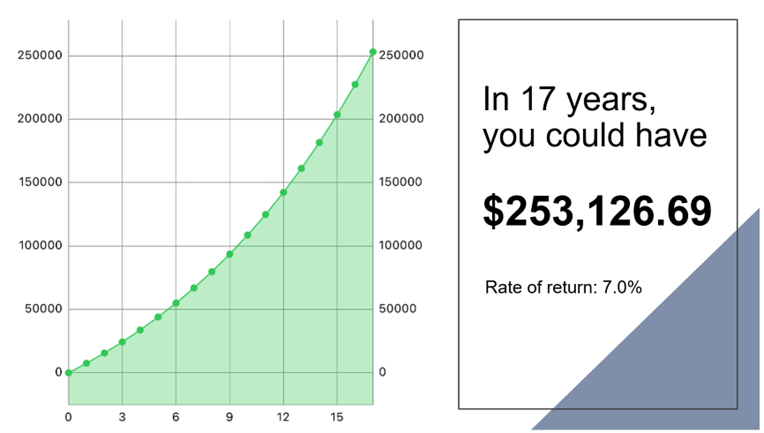

If you contribute $7,500 each year from age 50 to age 67 (17 years), you can make a big impact on your future.

*This example is intended for illustrative purposes only.

When am I eligible to make a catch-up contribution?

If you turn age 50 anytime in the calendar year, you are eligible to contribute an additional $7,500 into your plan as a catch-up contribution. This is in addition to the $22,500 annual limit.

Is the catch-up contribution pre-tax or Roth?

Yes, either type of savings are available for your catch-up contribution. Depending on your income, the Secure Act 2.0 may require a change for your situation to Roth (more information to follow).

What does this all mean?

If you wish to save an additional $7,500 per year, you can accumulate over $250,000 in the next 17 years! As the limits to save increase, you may be able to save even more each year.

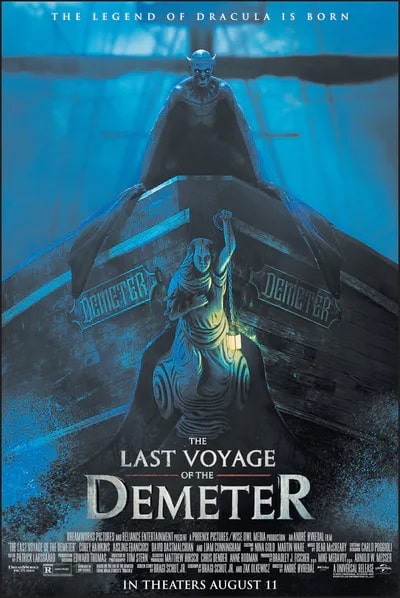

Mr. C’s Movie Review

And WE ARE BACK. After a detour last month reviewing Spider Man, we tackle a classic tale this month…. The Last Voyage of the Demeter. For those of you that are unfamiliar with the Demeter, its the ship Dracula was smuggled on to terrorize London. This film is no character study and takes great liberties with the origin story of Dracula. Regardless, buckle up for a blood soaked voyage. The gore factor in this film may drive away the non diehard fans. The movie starts with an ominous view of “50” unmarked wooden crates being loaded on to the Demeter. The Captain puts the offer out to men of Carpathia to work on the ship and earn their way to London. For one group of prospective sailors, the symbol on the crate is enough to pass on the wage. So kicks off our story. Corey Hawkins (Dr. Dre from Straight out of Compton) plays the lead role of Clemons, a collage educated Doctor trying to make sense of the evil on board. One by one, each of the crew is introduced to the titular character but few live to tell about it.

On a Scale of “Like It”, “Love It”, or “Gotta Have It”…..I give this movie a “Like it”. I’ve seen better portrayals of Dracula (see Blade) but the savagery bestowed on the crew of the Demeter is unrelenting and provides the entertainment factor for the horror aficionado. Don’t run to see it but if it pops up on Netflix, take it for a ride.