“Life is what we make it. Always has been, always will be.”

-Grandma Moses

Welcome to the October Edition of Ryan’s Retirement Ramblings – The monthly newsletter that will bring you the latest developments from the qualified plan space & provide updates for the retirement team at Wheeler Associates & DeGraaf Financial.

On A Personal Note…

A picture of my wife and me saying goodbye to Summer at Target Field. I was so excited the Twins actually won a series and advanced to the Divisional round. I was able to secure “2” tickets to watch them beat up on the Houston Astros. Gorgeous fall day and getting to spend it with such beautiful company……….we waived our Homer Hankies to get hyped and Twins are down 4-0 after 1!!!!! Ha. All and all a great experience but could have really used the “W”. Happy Fall!

The Tomassoni family dove back into the messy face paint again this year. They chose Willy Wonka and the Chocolate Factory for their annual family Halloween costume theme.

If Social Security benefits were cut, here’s how much more you’d need to save for retirement

- If Social Security benefits were reduced or eliminated, Americans would need to double or triple their savings rate to retire with a sufficient nest egg.

- Meanwhile, “the old-age poverty rate would soar,” said Richard Johnson, a senior fellow at the Urban Institute.

- Social Security is the main source of income for Americans age 65 and older.

Hardship Distributions Surge: Strategies for a Troubling Trend

More and more workers are taking hardship distributions from their 401(k) accounts, a recent report shows. Bank of America’s June 2023 Participant Pulse study reveals nearly 16,000 participants withdrew money to cover a financial hardship in Q2 of this year — up 36% compared to the same quarter in 2022.

At the same time, the New York Federal Reserve reported in August that credit card debt among U.S. households exceeded $1 trillion for the first time ever, with an increase of $45 billion in Q2 alone. Moreover, the rate of credit card delinquencies rose to 7.2% during the same quarter — the highest rate since 2012.

In this challenging environment, how can plan sponsors support participants who may be struggling with high debt and help them avoid raiding their retirement savings to stay afloat?

Plan Sponsors Can Help Social Security Early Birds Build Their Retirement Nest Egg

Two-fifths of pre-retirees say they plan to start taking Social Security benefits before they reach full retirement age, according to a recent Schroders report. And just 10% intend to wait until age 70 in order to qualify for maximum payments.

Nearly half of participants cite fears about the future solvency of Social Security, and 72% say they plan on receiving benefits early despite knowing it will lower their monthly disbursements. But it’s unclear to what extent they understand how the reduction in payments may impact their overall retirement readiness.

Reduced Social Security benefits put more pressure on 401(k)s and personal savings to meet financial needs during retirement. Sponsors can assist by helping employees plan ahead and tailor their strategies with an early benefits election in mind.

A direct and compelling headline

In the modern era of numerous investment options and economic challenges, understanding the concept of money, known as financial literacy, holds significant importance.

Defining financial literacy can vary slightly among retirement experts and can negatively affect their financial decisions. Some fundamental components of financial literacy include gaining knowledge regarding effective management of money and debt such as Budgeting, Investing, Borrowing, Taxation and Personal Financial Management.

Now, where can you gain this knowledge? Written in an article that was published by the Corporate Finance Institute, they listed a few tools an individual can use to gain literacy.

Participant Corner

You’ve been diligent—saving, monitoring retirement accounts, consulting your advisor. But are you prepared for life’s uncertainties? Your retirement plan relies on assumptions: savings, investment duration, inflation, and returns. Life, however, loves throwing curveballs—job loss, health issues, financial shocks.

That’s where stress testing comes in, your safety net in this unpredictable journey. Ready for a stress test?

Retirement Planning and Stress Testing Quiz

1. What does stress testing typically involve in financial planning?

A) Implementing the same assumptions for returns, inflation, and financial stability.

B) Ignoring assumptions and relying solely on historical data.

C) Introducing various assumptions related to returns, inflation, and personal financial stability.

D) Exclusively focusing on returns without considering other factors.

2. What resource should you use when evaluating the assumptions in your retirement plan to fully grasp the complexity of economic forces and life’s unexpected turns?

A) Online Calculators

B) Consult with your Financial Advisor

C) Historical Records

D) A Crystal Ball

3. When addressing potential risks highlighted during stress testing, what strategies are mentioned for managing these risks and uncertainties?

A) Stick to your original financial plan regardless of the stress test results.

B) Consult an astrologer for financial guidance.

C) Increase your investment in high-risk assets.

D) Discuss possible changes with your financial advisor, consider diversification, and explore insurance options.

**Click To Read More for answer key

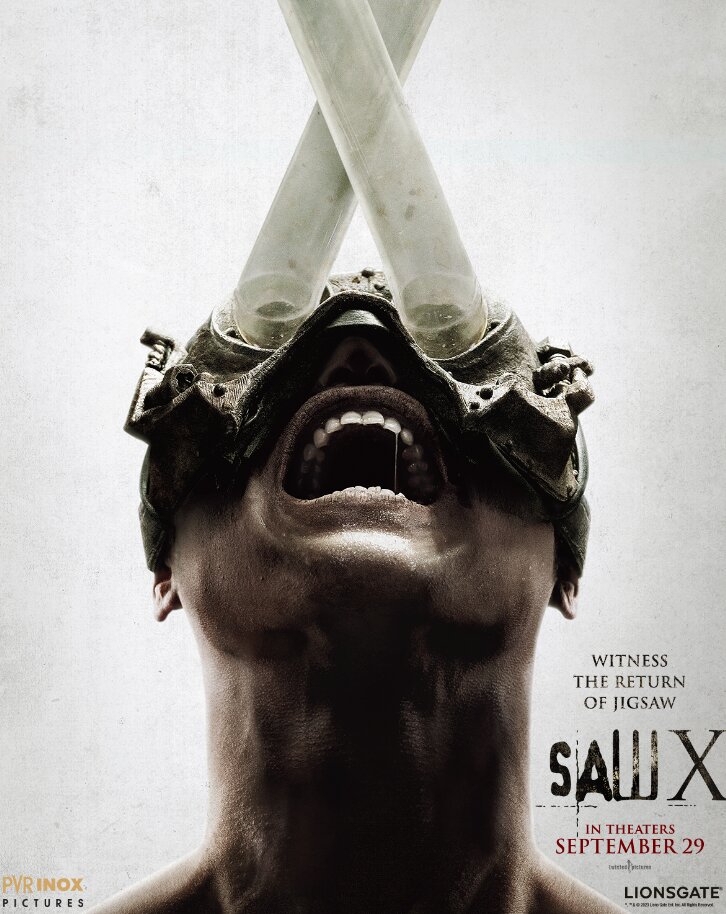

Mr. C’s Movie Review

I think the Movie Poster sums it up pretty well. It wouldn’t be Halloween without an annual visit from our favorite movie villain, John Kramer a/k/a JIGSAW. The prodigal protagonist returns for another addition of the franchise in SAW X. This Taking place between the events of the original SAW and SAW II , John travels to Mexico searching for a miraculous cure to terminal cancer. After undergoing what seemed to be a risky and experimental procedure, John discovers the entire operation was a scam to defraud those on death’s door. John exits stage right and JIGSAW is armed with newfound purpose to torture the scam artists. SAW X might be the goriest chapter in the saga and for me, it was the most complete story of the franchise. I felt the movie highlighted John’s decent into the madness of embodying JIGSAW. The deranged traps for fans of the SAW franchise are second to none. Get ready for John and Amanda (Shawnee Smith) most devious game.

On a Scale of “Like It”, “Love It”, or “Gotta Have It”…..I give this movie a “Gotta Have It” if the SAW movies are in your Horror playbook. Torture porn at its best. The opening apparatus (seen on poster) will haunt you until next Halloween when JIGSAW returns.

On a brighter note for those that cannot stomach the SAW movies, I’ve included a little short on what it might be like to live with JIGSAW. The “GAME” is not to laugh. Living with JIGSAW