“The bad news is that time flies. The good news is you’re the pilot.”

-Michael Altshuler

Welcome to the January Edition of Ryan’s Retirement Ramblings – The monthly newsletter that will bring you the latest developments from the qualified plan space & provide updates for the retirement team at Wheeler Retirement Plans.

On A Personal Note…

The Cooles made a trip down to the ESPN Wide World of Sports park in Florida to watch the UDA Collegiate Dance and Cheer Championships. Our senior and UMD Bulldog teammates made Duluth proud again this year taking home “2nd” in Jazz and “3rd” in Pom. They were unable to defend their National Championship but the girls walked away Champions for Duluth. Proud dad and head Bulldog cheerleader. Ha.

IRS announces 2024 retirement account contribution limits: $23,000 for 401(k) plans, $7,000 for IRAs

- The IRS has increased the 401(k) plan contribution limits for 2024, allowing employees to defer up to $23,000 into workplace plans, up from $22,500 in 2023.

- The agency also boosted contributions for individual retirement accounts to $7,000 for 2024, up from $6,500.

Proposed Legislation Aims to Help Young Workers Put Time on Their Side….

Retirement planning often directs attention toward mid-career 401(k) participants and those nearing retirement — and understandably so, given their tighter timeline to secure post-retirement financial stability. But what about the youngest members of the workforce — the 18- to 20-year-olds, or those even younger?

This demographic faces a potentially more challenging economic outlook then…….

Surging Credit Card Debt: Strategies for Plan Sponsors to Help Bolster Retirement Readiness

With U.S. credit card debt recently soaring to a record high of $1.08 trillion, retirement plan sponsors face a pivotal moment. This staggering amount, a $48 billion escalation since the second quarter and a $154 billion increase year-over-year, is a cautionary signal for Americans’ financial stability.

The compounding pressures of post-pandemic recovery and inflation………

PEPs Demonstrate Benefits for University Plan Sponsors

When it comes to higher education institutions, pooled retirement plan structures offer a wide range of benefits, including exposure, as well as fewer administrative functions and more opportunities to provide educational resources, according to new research.

Pooled employer plans are more likely than single-employer plans to enable university faculty and staff, particularly for those who work part-time, to take part in retirement plans; as found in a recent study, “Retirement Plan Trends in Higher Education 2023,” by Transamerica Corp.’s. It is primarily due to simplified employee pension plans (SEPS) are less likely to extend to these workers, according to survey results.

Participant Corner

Navigating Retirement’s New Horizons

As we embrace the dawn of a new year, contemplating the departure of a loved one may not be the most festive topic, yet it’s an essential consideration for any forward-thinking planner. When you initially chose your retirement plan, you were likely prompted to designate a beneficiary.

Here are some tips tailored for the new year as you update your beneficiary information:

- New Year, Fresh Financial Check: Start the year by reviewing your retirement savings account. Unlike a New Year’s resolution that may fade, this commitment ensures your financial affairs are in order. The assets in your retirement account won’t follow the notes of your will; they’ll dance to the beneficiaries named on the account. Keep this list current for a harmonious financial future.

- Spousal Consent Symphony: It’s imperative to obtain your spouse’s signature consent, as official as the stroke of midnight, to designate beneficiaries beyond your spouse.

- Life’s Turning Points: Acknowledge life’s significant events, from the exciting birth of a child to the contemplative aftermath of a divorce. Update your beneficiaries accordingly, with your plan advisor as your trusted guide through life’s twists and turns.

- Keeping the Financial Score: Like a New Year’s countdown, your beneficiary form requires consistent attention. Plan for your financial future with the precision of a New Year’s celebration, ensuring your assets are distributed as intended.

In the spirit of new beginnings, remember that planning for retirement and staying current with your plan is crucial, even in the face of unforeseen challenges.

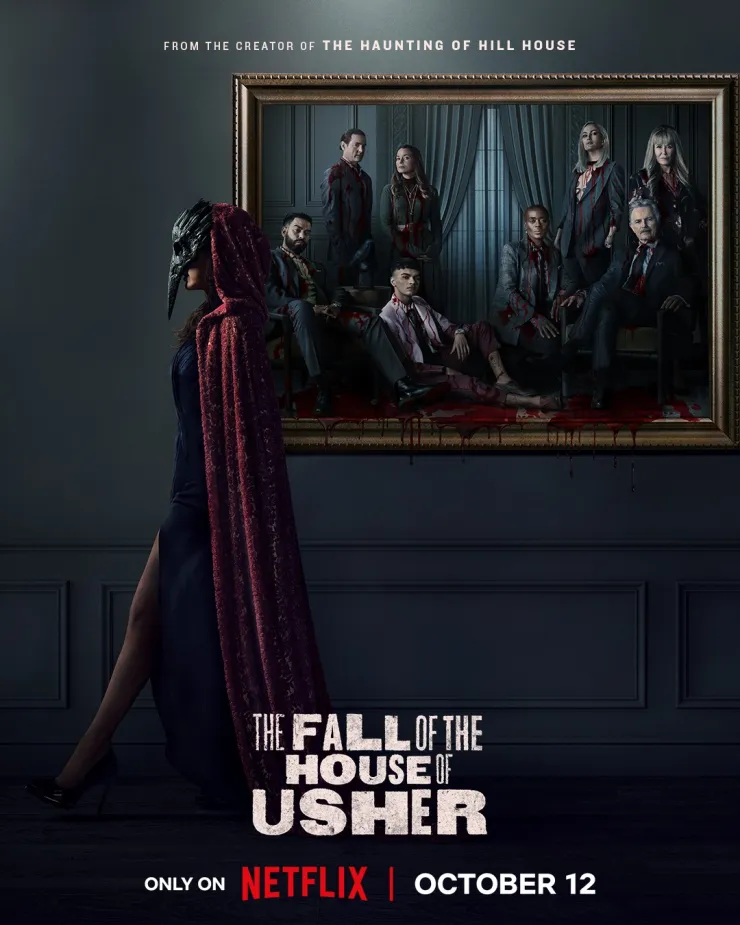

Mr. C’s Movie Review

Sometimes I take a big swing and binge watch a Netflix, Apple TV and/or Paramount show. The show’s advertising, poster or stars stir up something in my mind. Down the rabbit hole I’ll fall over the course of a weekend. 9 out of 10 times I sit back and say “Can’t get those 12 hours back”. The Fall of the House of Usher was not only a surprise in horror genre but the sheer amount of gore was captivating. As the title suggests, the “8” episode series follows the Usher Family’s children’s plight to the family fortune acquired on the back of shady “BIG PHARM”. The actors may not be a who’s who of Hollywood but hard core movie watchers may recognize Frederick Usher as the child actor that phoned home. The district attorney played brilliantly Carl Lumbly spends the entirety of the season pursuing a conviction on the Usher Matriarchs; Roderick and Madeline. The trial of the century begins while the Usher children start dying in mysterious fashion. Queue; Verna, the devilishly evil Carla Gugino to add the creepiness driving the family mad. Death has called on Roderick and Madeline; only they know who death is.

On a Scale of “Like It”, “Love It”, or “Gotta Have It”…..I give this show a “Love It”. The show’s creator dedicated an episode to each member of the family which put the viewer on the inside of the family dynamic. The series is well paced and worth a rainy weekend.