“The will to win is not nearly as important as the will to prepare to win.”

-Bobby Knight

Welcome to the August Edition of Ryan’s Retirement Ramblings – The monthly newsletter that will bring you the latest developments from the qualified plan space & provide updates for the retirement team at Wheeler Associates.

On A Personal Note

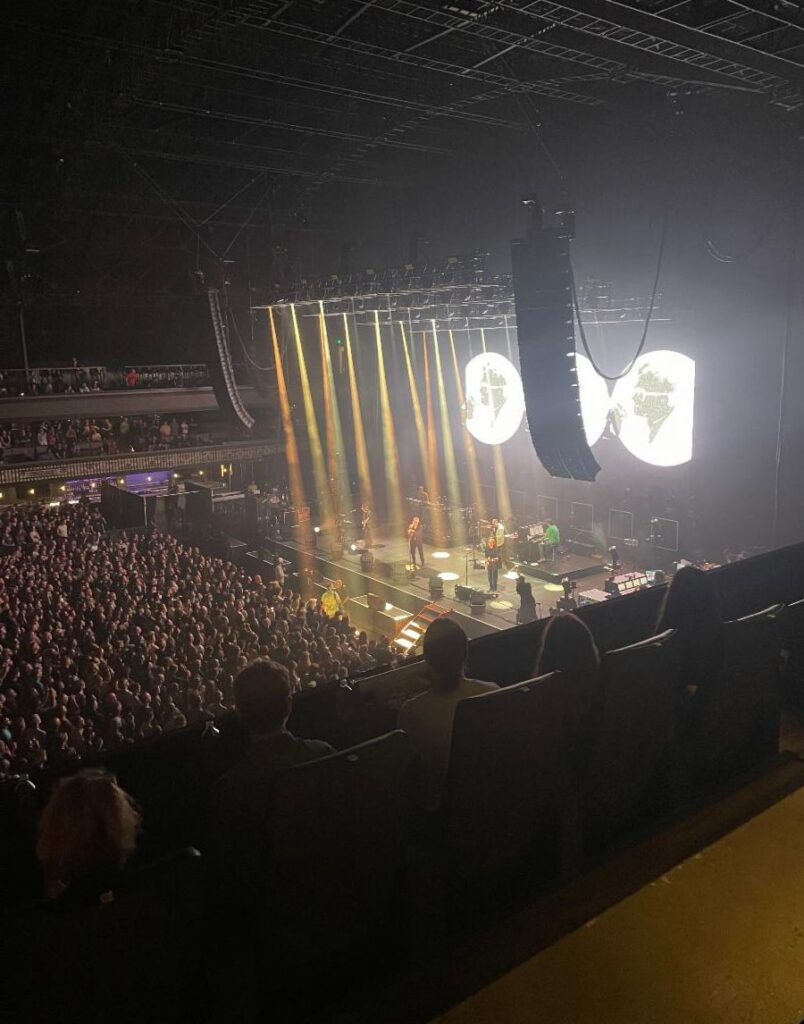

For those of you that know me well, I thoroughly enjoy attending concerts. I’ve probably logged close to “100” over the past 25+ years. In fact, I love attending them so much that I attend many of them solo by traveling down/back to Minneapolis as day trip. This past month, I not only visited a venue for the first time but I would put it in the top “3” venues I’ve taken in a show. “The Armory” in downtown Minneapolis is top notch. It fills the venue gap between the large shows held at Xcel, Target Center, US Bank and smaller shows ala First Ave., Fine Line, Varsity Theatre. On this special occasion I heard what might be my favorite band; The National. Check out their new Album, “First Two Pages of Frankenstein”; you will not be disappointed.

It was a busy month in the Tomassoni household. Tiffany and Dante organized the David Tomassoni ALS Golf Scramble at Fortune Bay. They had a blast and their fundraiser raised over $20,000 for Never Surrender, Inc. The funds will be used to benefit individuals living with ALS and helping to find a cure for the terrible disease.

In other news, little Cecilia was so excited to “graduate” preschool at the YMCA last week and is very excited for her next chapter.

401(K) hardship withdrawals are on the rise. They’re ‘the worst way’ to tap funds, expert says

- After falling sharply last year, retirement account balances are bouncing back in 2023.

- However, recent reports by Fidelity Investments, Bank of America and Vanguard all found that hardship withdrawals are also on the rise.

- “Hardship withdrawals are the worst way to get money out of a 401(k),” one expert said.

Employees Want Financial Planning Support – and Aren’t Afraid to Ask for it

Financial stressors including stubbornly high inflation and historic levels of credit card debt continue to impact workers across a wide range of income brackets.

Twenty-eight percent of full-time employees often or always run out of money between paychecks, as do 15% of those who earn $100,000 or more per year, according to PwC’s 2023 Employee Financial Wellness survey. And among workers who carry balances on their credit cards, 44% say they struggle to make their monthly minimum payments on time…

A Crisis of Confidence

According to the Employee Benefit Research Institute’s 2023 Retirement Confidence Survey of 2,357 Americans, workers’ and retirees’ confidence that they’ll have enough savings to comfortably support themselves through retirement has dropped to levels not seen since the 2008 global financial crisis.

The findings show 64% of workers feel “at least somewhat confident,” with only 18% feeling “very confident” as they remain concerned about inflation and the possibility of recession. Employers can deploy a number of strategies to help…

SECURE Act 2.0: Key Changes for 2024

To most, the SECURE Act 2.0 appeared to predominantly outline optional changes that go into effect over the span of 10 years. However, there are a few mandatory changes taking effect in 2024 that plan sponsors will need to comply with. These provisions require sponsors to work with their advisors, recordkeepers, and providers to develop a strategy for incorporating them into their plan design, as well as dealing with the cost implications that come with it.

The biggest mandatory change coming next year is the requirement that catch-up contributions made by high-income earners be treated as after-tax contributions. This means that starting in 2024, employees making catch-up contributions who earn at least $145,000, and are 50 years or older, must be contributing into a Roth account.

For sponsors who don’t currently offer employees a Roth, this poses a challenge. They will be faced with the decision of either establishing a Roth option to satisfy this provision or eliminating the catch-up contribution program for high-income earners. As most sponsors are choosing the first option, employees will be strongly encouraged to adopt a Roth 401(k) to begin with.

Other mandatory changes to look out for in 2024…

Participant Corner

Are you prepared for a secure financial future? Discover some key aspects of a comprehensive risk management strategy.

• Disability Income Protection: Protect your income by obtaining disability income protection. Purchase it when you are young and healthy, considering factors like occupational specialty coverage, ensuring future income increases, and prioritizing individual plans over group coverage.

• Property and Casualty Protection: Property and casualty insurance (P&C) protects us against damage and protect against liability. Auto insurance, homeowner’s insurance, renter’s insurance, and personal liability insurance are all forms of P&C coverage. The higher deductible levels will lower your premium costs which should be redirected towards increasing your liability limits.

• Personal Liability Protection: Often overlooked, personal liability insurance provides extensive protection at a low cost. Consider obtaining umbrella liability protection equivalent to your assets’ value.

• Life Insurance Protection: Life insurance serves various purposes, such as creating an instant estate, providing tax advantages, and offering cost-effective solutions. Don’t wait too long to purchase life insurance; buy it when you are young and healthy.

Mr. C’s Movie Review

Bear with me this month as I step outside the comfort of the Horror genre and watched Spiderman: Across the Spider Verse. It was SOOOO good. The little kid in me thoroughly enjoyed the comic book hero in the latest installment of Marvel’s flag ship movie franchise. I have to admit that I knew little of the much talked about Multi-Verse but count me a believer after this story. Miles Morales picks right up where he left off in 2018’s “Into the Spider Verse” Miles follows fellow SpiderWoman, Gwen Stacey, into the Multi-Verse where he is introduced to the plethora of Spidermen that protect each of their worlds. The Easter Eggs and sheer amount of Spideys make for a ton of fun. I laughed at how outrageous some of the Spidermen came to be. Despite all the fun, Miles clashes with his new found allies in how to best handle the threat of fate. Without giving away too many spoilers, Miles must make the ultimate choice of saving the few for the sacrifice of many.

On a Scale of “Like It”, “Love It”, or “Gotta Have It”…..I give this movie a “Love It”. The depth of the Spider Verse was amazing. The animation is breathtaking in a way that is so different than the Pixar worlds we’ve come to know. Give this one a try as you let your psyche heal from the bombardment of horror movies that have been consumed.